Collateralized Loan Obligations (CLOs): The Smart Investor's Hidden Treasure?

An overlooked asset class potentially offering downside protection and sustainable cash yields in the broader credit market?

Please note: The statements in this publication are intended to encourage the exchange of individual investment experiences. All views expressed are solely those of the respective authors and are not affiliated with or reflective of any company’s activities. Investing involves risks. Please refer to our disclaimers.

Introduction

Collateralized Loan Obligations (CLOs) have been around for decades, consistently offering stable returns, low default rates, and resilience across economic cycles compared to other asset classes.1 So why do so many investors overlook CLOs as potential investment?

The main reason is complexity. CLOs are often seen as opaque and filled with technical jargon, making them seem intimidating. But for those investors who take the time to understand them, CLOs offer a complexity premium—a higher reward paid to those investors willing to dig deeper into their structure.

This article tries to simplify CLOs, using analogies to break down their mechanics and highlight why sophisticated investors should pay attention to this often-misunderstood asset class as it is able to deliver stable returns based on the secured asset class “private corporate loans”.2

What Are CLOs?

CLOs are portfolios of corporate loans (asset side) bundled into an investment product, then divided into different layers of risk and return (called tranches). The asset side is financed by CLO investors (liability side and equity contribution). We can think of it like buying a rental property or financing a car dealership.

1. Example: CLOs as a House with a Mortgage

Imagine you are buying a rental property (asset side as a CLO). Instead of paying in full, you take out a mortgage (debt tranches) to finance part of it (liability side). The rent from your tenants (loan payments from companies) covers your mortgage and generates profit.

Senior Tranche (AAA-rated) = The bank lending you the mortgage. The bank gets paid first, reducing the risk of default to a minimum.

Mezzanine Tranche (BBB/BB-rated) = A second lender or equity partner. They earn higher returns but take on more risk.

Equity Tranche (Unrated/High-Yield) = The property owner, who keeps any excess earnings (whatever money is left after paying everyone else). The owner has the highest upside but carries the highest risk.

Just like in real estate, those who get paid first take the least risk, while those investors willing to take more risk have the highest potential rewards.

2. Example: CLOs as a Car Loan Portfolio

Think of CLOs as a car dealership financing operation. Instead of selling cars one by one, a dealer offers financing options to their customer. Instead of keeping all the loans, the dealer bundles them together (asset side) and sells portions to investors (liability and equity side).

A-tranches (AAA/AA/A) = The safest investors. They get the first payments from the loans which include interest and any receipts from down payments (amortisations).

B-tranches (BBB/BB/B)= Mid-level investors. They get paid after the A-tranche investors.

Equity-tranche = The riskiest investors. They get whatever earnings are left but earn the most if customers pay on time and in full.

This structure ensures that even if some car buyers default on their loans, the top-tier investors still get their money first, making CLOs safer than they appear.3

Why Are CLOs Misunderstood?

Despite their well-structured design, CLOs are widely underappreciated for three main reasons:

1. Confusion with CDOs (Collateralized Debt Obligations)

Many investors associate CLOs with CDOs, which were one of the sources of the 2008 financial crisis. However, CLOs are very, very different—they are backed by corporate loans, not by subprime mortgages. In fact the only thing they have in common are the terms “collateralised” and “obligations”. Two out of three letters. But the important letter is in the middle. What is critical is what underlying assets are ‘collateralised’ (added to the structure). In the case of CLOs it is loans to large corporate borrowers, not home loans to individuals with weak credit ratings.

Corporate loans benefit from some major advantages and that is why CLOs performed well during the 2008 crisis, with all A-rated senior tranches experiencing no defaults.4

As mentioned, CLOs are investment products backed by assets (i.e. a portfolio of corporate loans). Those assets generate cashflows which are then paid out to the CLO investors in accordance with so called ‘waterfall rules’ . Different investors have different level of risk tolerance. CLOs offer different risk levels through their underlying tranches: low risk CLO A-tranches to medium risk CLO B-tranches and CLO equity for investors with a desire to capture additional upside potential. All CLO tranches benefit from the same underlying pool of assets ‒ a diversified pool of corporate loans.

2. Complexity Creates a Psychological Barrier

Many investors are comfortable with stocks and bonds but shy away from financial terms like ‘tranches’ or ‘credit risk waterfalls’. This complexity keeps many investors from exploring the opportunity further.

3. Lack of Public Market Visibility

Unlike stocks or corporate bonds, CLOs are not covered by mainstream financial media. They are primarily traded in institutional markets, making them less familiar to retail and even some institutional investors.

The last two items (complexity and lack of public visibility) are the biggest hurdles for family offices and HNWIs to consider CLO investments. The complexity appears to be a deterrent because no investor wants to read and interpret 600 pages of legal documentation. In addition, who has the expertise to evaluate the risks correctly?

However, CLO managers have a very good track record in managing CLOs.5 There are some Diversified Credit Funds, which have made good investments in diversified portfolios of CLOs.6 Such diversification is important to further protect from downside risks.7

And the fact that the price of CLO tranches is not readily available to the wide public also appears to be a deterrent. But where is it written, that investments which are valued on a public market are better than private investments? Nowhere. It is the opposite, investors get a higher return in private markets than in public markets.8

Why are CLOs potentially attractive for professional investors?

There are two main points why CLOs should be considered by any diversified credit investor:

Managed Risk (i.e. low default rates); and

Attractive Returns (8 ‒ 15% IRR)9

A) How do CLOs manage risk and how well have they protected investor capital in the past?

1. Diversification of the underlying loan portfolio

CLOs invest in a broad portfolio of 200‒300 corporate loans across multiple industries, geographic regions, and credit ratings. Such diversification reduces default risk of single borrowers. Even if one company becomes insolvent, the CLO structure typically absorbs such loss, protecting investors who have invested in the senior tranches of the CLO.10 Because diversification is so important, the CLOs portfolios are frequently tested independently. Failing such tests typically requires corrective actions by the CLO manager to reduce risk and enhance the credit quality in the portfolio.

2. Uncorrelated Assets

Diversification is an important element of CLO structures. More important though is ‘uncorrelated’ diversification. There is no point diversifying into 1,000s of underlying assets if these assets all correlated to each other, which means their values move in tandem. This was the main issue with CDOs during the financial crisis of 2008 and 2009. The underlying asset pools were comprised of home mortgages backed by individuals with very low credit scores. Once the financial crisis hit all borrowers faced the same problem: they lost their jobs, their property values declined, leaving them unable to pay the interest of their mortgages. In fact as the value of their homes decreased their mortgages exceeded the value of their homes, forcing borrowers to leave their homes.

Typically, CLO pools of assets have a much smaller correlation than CDO. Corporates across a wide range of industries, geographies, sizes and ratings are much more stable during times of financial stress, such as recessions, inflationary costs pressures, raw material price increases and changes in consumer behaviour. This is uncorrelated diversification.11

3. Active Portfolio Management

CLO managers actively monitor and trade loans within the portfolio, replacing underperforming assets with higher quality loans which reduces the volatility of earnings. Active portfolio management is important and is a key benefit compared to passive structures like static securitizations vehicles, for example public bond funds or ETFs. In fact CLO managers are legally required to meet certain diversification and loan quality metrics. All criteria are tested monthly by independent organisations (rating agencies).

Imagine a CEO, who operates under strict rules in relation to product quality and business risks. Once set company metrics breach any limits the CEO would be required to act.

4. Overcollateralization

‘Overcollateralization’ is a feature of CLOs that ensures that there the value of the asset pool (corporate loan portfolio) exceeds the pay-out obligations to CLO investors. Again, by design CLO managers are required to employ overcollateralization (OC) and interest coverage (IC) tests to ensure sufficient collateral value (loan cashflows) is available to meet the payments to investors.

If any of the OC or IC tests fail, cash flows are redirected to senior tranches, preventing excessive losses in lower tranches.

How well have CLO’s protected investor capital in the past and how to mitigate any residual risk?

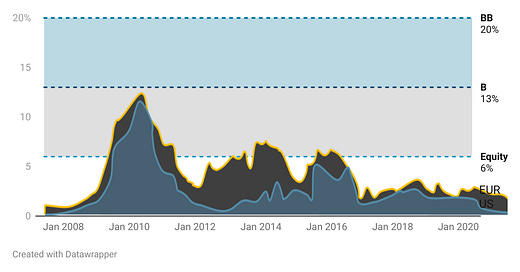

Default Risk: In case underlying loans are not being paid back to the CLO (a default on the asset side), structurally lower tranches (B and equity tranches) absorb the losses first. However CLOs structures have withstood even the most difficult financial crises in the past (see graphics below).12

When comparing peak loan market defaults during crisis times 2008 ‒ 2010, we can see how resilient typical CLOs structures were.

Selecting blue chip CLO Managers and diversifying across multiple CLO vintages and CLO tranches would have further reduced annual default rates.13

The evidence on CLOs historical default rates shows that investment-grade CLO tranches (AAA, AA, A) have had very low default rates—even during major economic downturns:14

Key Takeaways from the CLO Risk data

- AAA and AA CLO tranches have virtually never defaulted—even during recessions.

- A and BBB tranches registered minimal defaults, proving they are more resilient than many corporate bonds.

- BB tranches are riskier but still outperformed high-yield corporate bonds in downturns.

This data highlights why AAA and AA CLO tranches are among the safest fixed-income investments, even during economic crises.15

B) What is the reason for the attractive CLO returns?

CLOs are institutional investment products and therefore typically only offered to professional Investors. Institutions generally demand a premium for any private market investments compared to similar-risk public market investments due to factors such as illiquidity and complexity. CLOs are no different in that respect. Professional investors who develop an understanding of CLOs could earn those premia as well.

1. Illiquidity Premium: why patient investors are rewarded

Private market investments are generally less liquid than public market securities, meaning investors cannot as easily sell their holdings without potentially incurring significant delays. To compensate for this illiquidity, investors demand higher returns. A study by AQR Capital Management suggests that investors should require a 4% – 6% illiquidity premium to lock up their capital for 5 – 10 years.

While stocks typically trade instantly, corporate loans trade less instantly (in days-weeks). CLOs take even longer and sometimes even remain illiquid for some time until the market opens up again.16

2. Complexity Premium: why smart investors are rewarded

Private market investments like CLOs often involve more complex structures and require extensive due diligence. This complexity can deter some investors, leading those who are willing to navigate these challenges to demand higher returns.

Higher Yields for Similar Credit Risk For example, a AAA-rated CLO tranche may yield 1 ‒ 2% more than a AAA corporate bond—while maintaining similar or lower default risk.

In addition, CLOs mitigate interest rate risk as most of the CLO loans have floating interest rates, meaning they pay higher interest when central banks raise rates. Unlike traditional bonds, which lose value when rates go up, CLOs actually benefit in inflationary environments.

So how do CLOs compare to other asset classes?

In summary, CLOs are attractive because they offer enhanced returns for lower levels of risk. Institutional investors have long noticed the various features of CLOs.17

C) How Can Investors Access CLOs?

For investors looking to gain exposure to CLOs, here are several options:

Direct Investment in CLO Tranches – this route is available to institutional investors only. Investments happen ‘over the counter’ at the trading desks of investment banks, in auctions or via primary issuances. Investors must consider a minimum investment of US$1‒ 2 million for one single CLO tranche. But a purchase of a CLO tranche requires the expertise to assess what is considered a good value CLO trade. A diversified portfolio should at least hold 30 ‒ 40 tranches to provide sufficient diversification.

Specialised Private Credit Funds provide diversified exposure with liquidity. Diversification is achieved through investments by the fund manager in a variety of CLO tranches, managed by different CLO managers (manager diversification), and issued at different times in the economic cycle (vintage diversification).

Conclusion: CLOs ‒ A potentially attractive opportunity?

CLOs are one of the most misunderstood yet compelling asset classes available today. Their structured design offers a unique way to access high-yield, low-default investments that actually benefit from rising interest rates.

We have been investing in CLOs for many years. For those family offices, institutional investors, and high-net worth individuals interested in earning a return premium, with a certain degree of capital protection and resilience during economic downturns, as well as high levels of diversification, CLOs may present an opportunity that should not be ignored.18

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing involves risk. Any expression of opinion is based on own research. Historic data may be interpreted differently under different circumstances. No advice. Only for professional investors who can afford to lose capital invested. Protections may or may not exist during different periods of time. In general, investments may be illiquid and not accessible for investors for extended periods of time. Products may not be regulated. Illiquidity and capital losses are inherent sources of risk. Never invest without understanding all risks which may materialise. Data can be interpreted differently and different sources may lead to different conclusions.

Source: own research: please refer to footnote (1).

Source: own research: please refer to footnote (1).

Source: own research: please refer to footnote (1).

Not all risks can be minimised. Diversification is a theoretical concept which is based on a number of assumptions. Such assumptions may not always exist in financial markets and therefore risks may materialise regardless of diversification.

Source: own research; please refer to footnote (1).

Source: own research: please refer to footnote (1) and (5).

General assumption, based on internal research over long periods of time. Results may differ during selected periods of time; please refer to footnote (1).

Source: own research: please refer to footnote (1).

For illustrative purposes only; results may be different during prolonged periods of financial distress.

‘Uncorrelated’ diversification does not mean there is no correlation. This is a illustrative concept which may or may not materialise in financial markets during different times and economic cycles.

Source: own research: please refer to footnote (1).

Theoretical calculations based on own research; please refer to footnote (1).

Based on historical default rates of CLOs dating back before 2008; according to data from S&P Global Ratings, Moody’s Investors Service, and Fitch Ratings.

Source: own research: please refer to footnote (1).

Source: AQR Asset Management (Demystifying CLOs).

Source: own research: please refer to footnote (1).

Source: own research: please refer to footnote (1).